401k After Tax Contribution Limits 2025 - 401k After Tax Contribution Limits 2025. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. This amount is up modestly from 2023, when the individual. The dollar limitation for catch. If you’re 50 or older, you can contribute up to $8,000.

401k After Tax Contribution Limits 2025. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. This amount is up modestly from 2023, when the individual.

Contribution Limits 401k 2025 After Tax Robin Leonie, In 2025, you can contribute up to $23,000 to your 401 (k).

401k Contribution Limits And Limits (Annual Guide), In 2025, for instance, the limit is $22,500 for those under 50,.

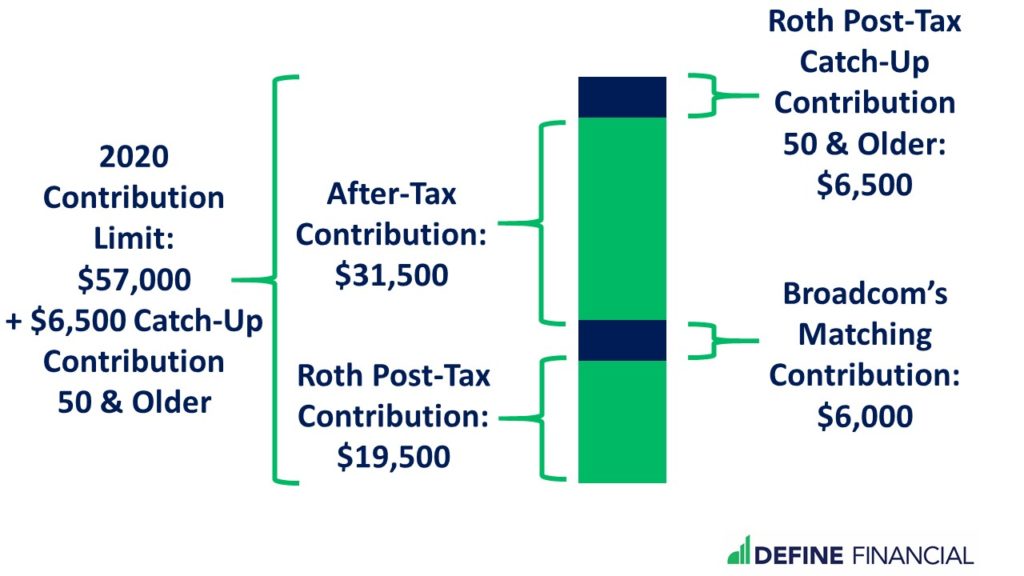

Employer 401k Contribution Limits 2025 Zonda Kerianne, The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

2025 Max Employee 401k Contribution Cari Marsha, As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

Irs 401k Total Contribution Limits 2025 Lory Donnamarie, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

401k Contribution Limits 2025 After Tax Gerry Kimbra, If you’re 50 or older, you can contribute up to $8,000.

401k Contribution Limits 2025 After Tax June Elsbeth, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

401k Limits 2025 After Tax Sayre Courtnay, The 401 (k) contribution limit is $23,000.

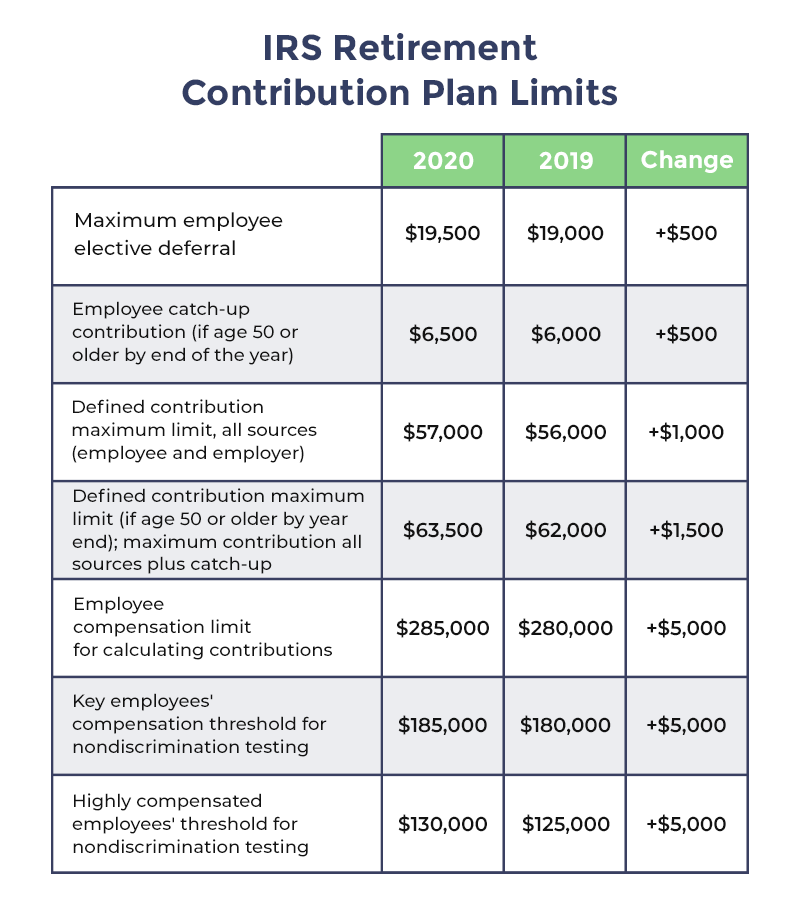

Contribution Limits 401k 2025 After Tax Franny Nikaniki, The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits.